Hi, I’m Faye Churchill and I lead HMRC’s Policy Lab team. We’ve been running for a year now so I thought it was about time to talk about what we do and why.

Hi, I’m Faye Churchill and I lead HMRC’s Policy Lab team. We’ve been running for a year now so I thought it was about time to talk about what we do and why.

Why do we have a Policy Lab?

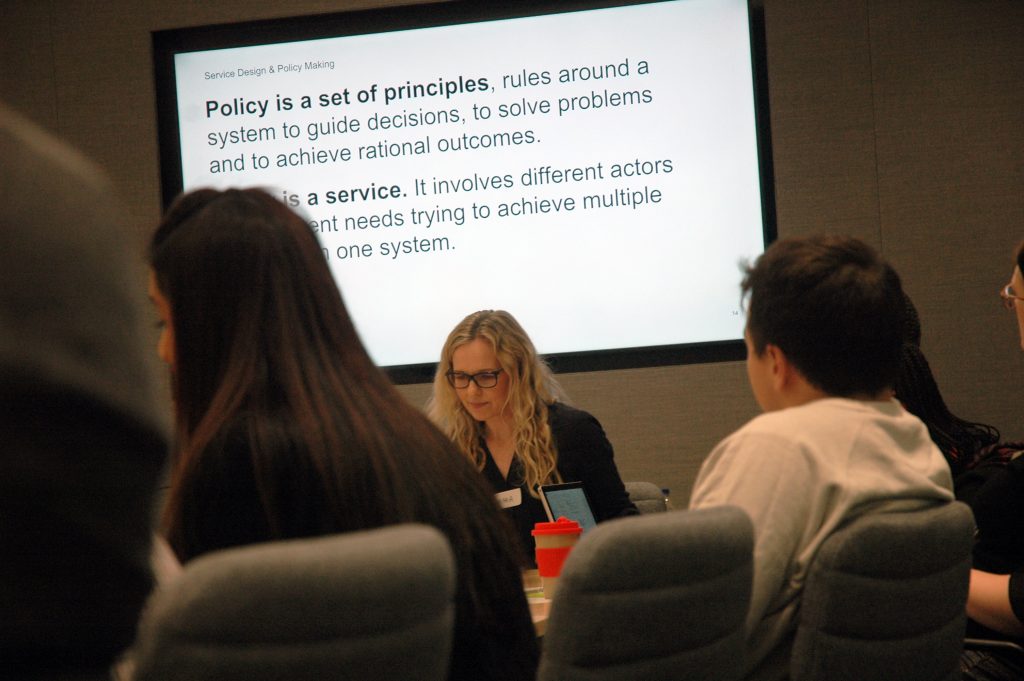

Policy making is at the core of work of Whitehall and it is crucial that the delivery of these policies meets the demands of the fast-paced and increasingly digital world. It needs policy making that is about developing and delivering information that is better designed for both the government and users.

HMRC’s Policy Lab, using Cabinet Office’s words, is to do just that to ‘develop policy in a more open, data-driven, digital and user centred way’. If we want HMRC’s policies to work we need to make sure users are at the heart of everything we do. So we help policy teams explore how taxes, reliefs and duties might work and to develop approaches to make it easier for customers to understand the ‘ask’ of these policies and how they can comply with them.

Our vision

HMRC set up their Policy Lab team in February 2018 with a vision of what we would do:

- have a user-focused approach ensuring that policy is feasible, meets its intent and delivers value for money

- put people at the centre of policy-making, to bring the best understanding of how policies might impact on people and government

- help policy makers shape policies making it easier for people to meet their obligations and to maximise government efficiency

- bridge the gap between government and citizens using creative tools and collaborative techniques to enhance conventional HMRC policy design

Our set up

In HMRC we have a core team of product managers, service designers and user researchers. Each policy project has at least one person from those professions, and we work collaboratively with our policy teams to take forward their policy challenges.

Collaboration is key to the work we do, everything is in partnership with our policy team. That means we prioritise the work we do together, they attend user research sessions and actively participate in design workshops. We hope it’s an enlightening, and fun experience - at least that's what feedback so far is telling us!

What have we been working on?

This is an interesting question as, more often than not, we have to tell people we can’t say - it can be a bit ‘secret squirrel’. Most of last year was spent on sensitive budget measures which meant we had to keep quiet about it. We got really good at working in sensitive environments from innovative approaches with user research to general day to day team working. It’s crucial that our policy teams trust us to act with discretion.

Where is the next year taking us and can you help?

Our Policy Lab is embryonic so we want to share with and learn from other Policy Labs, not least how other Policy Labs are measuring the success of their work. So if anyone working in the same field has some answers or ideas to share I’d love to hear them.

Faye Churchill, Head of HMRC Policy Lab

Check out our current vacancies. They're updated regularly so worth keeping an eye on.

Now you can follow us on Twitter @HMRCdigital

To make sure you don't miss any of our blog posts, sign up for email alerts

2 comments

Comment by Making Tax Digital team posted on

Making Tax Digital will reduce the time businesses spend on administration in the longer term and make it easier for them to get their tax right.

Making Tax Digital requires VAT registered businesses with a taxable turnover above the VAT registration threshold to keep records in a digital form and file their VAT Returns using software. We have worked very closely with the software industry and a wide and diverse range of software products is available, at varying price points, some 'from free', to give businesses and their agents choice in software that meets their needs and integrates with the running of the business. Businesses and agents in particular choose to use commercially available tax software. All MTD VAT software must integrate with the MTD VAT API so there will be no gaps in data, and there is a wide range of software products available, including 'bridging software', to integrate with existing businesses processes to minimise transition effort to MTD.

Comment by John Beckwith posted on

Hi Faye, It is great to hear about your policy lab, it is a great concept that many private organisations would do well to follow.

I am intrigued to understand how, as part of making tax digital, the HMRC decided to introduce a policy of stopping its customers from accessing a tried and tested free web front end solution (for VAT returns) in preference of numerous third party solutions, not under the control of HMRC, and more importantly...chargeable to your customers. Surely the current web front end calls upon the same API backend that is now the common integration bus for these new middleware providers?

From my opinion, this new policy will only serve to alienate your customers and through disruption of well known and practiced process, introduce errors and gaps in data. Lets be frank, there are many businesses out there that are not IT-centric!